Local News

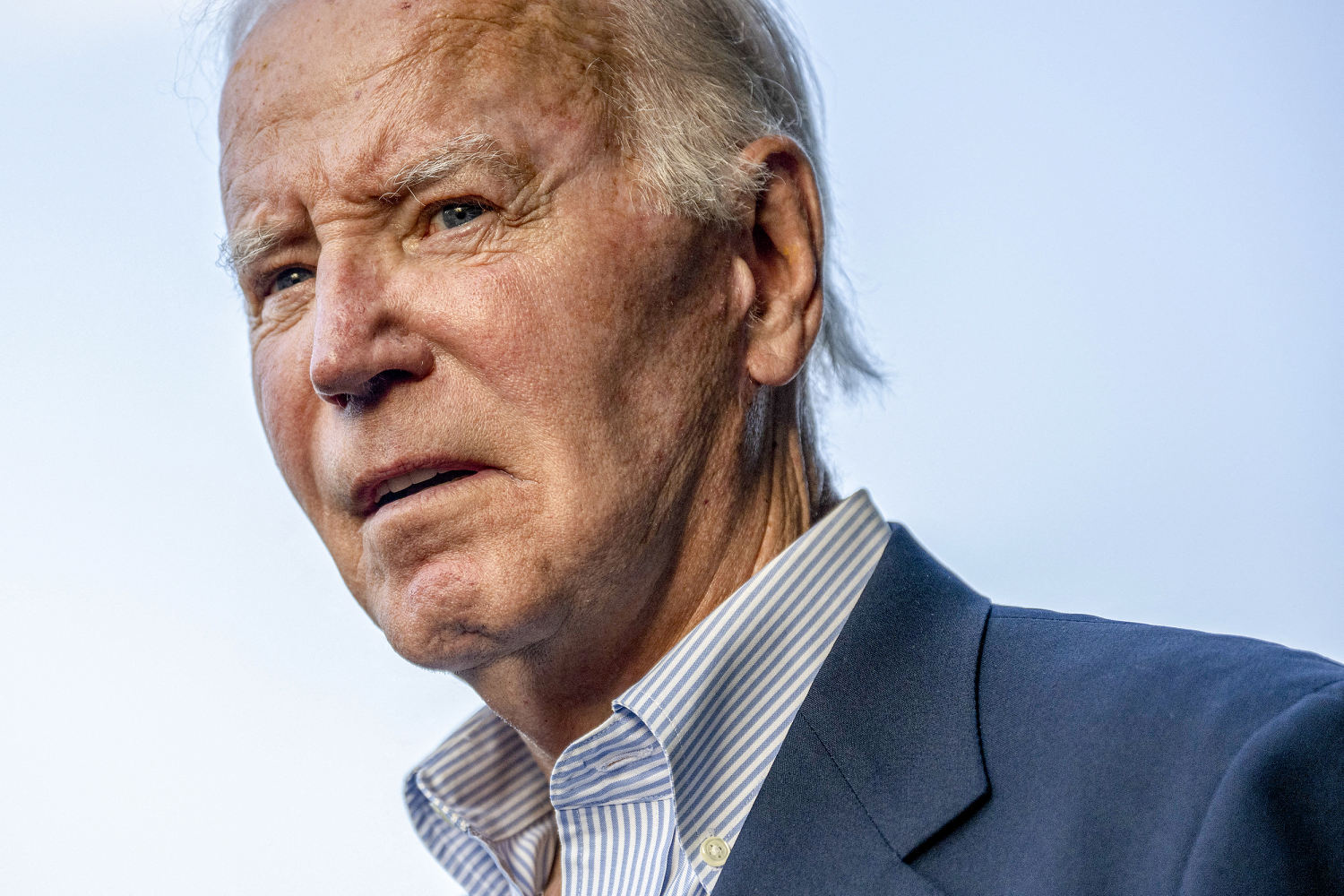

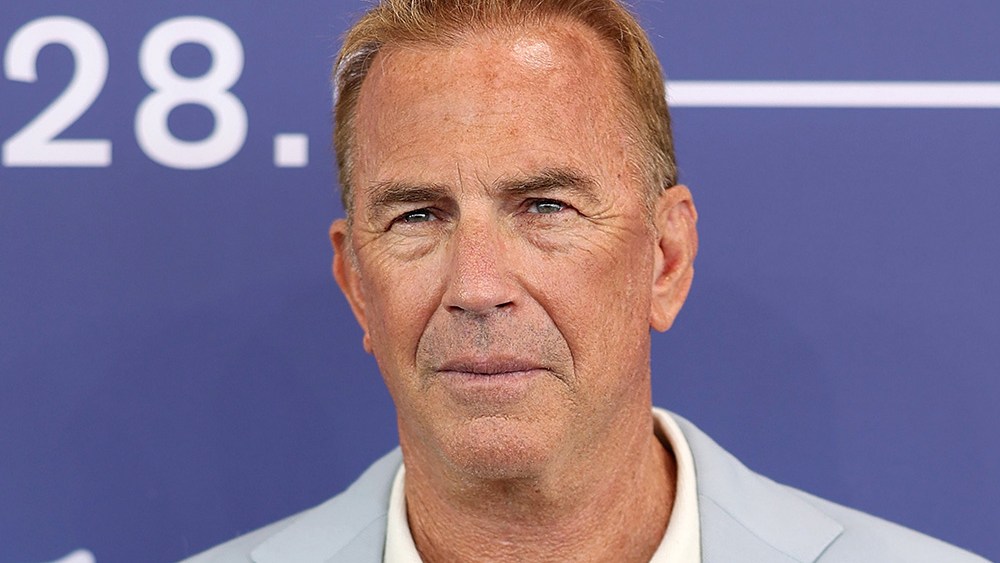

John Drivas owned and operated three restaurants in Massachusetts and New Hampshire.

The former owner of Red’s restaurants pleaded guilty on Friday to defrauding the IRS regarding federal employment taxes and the Massachusetts Department of Revenue for state meals taxes over a six-year period, officials say.

John Drivas, 66, was the owner and operator of Red’s Sandwich Shop in Salem, Mass., Red’s Kitchen and Tavern in Peabody, Mass., and Red’s Seabrook in Seabrook, N.H, according to a statement from the Department of Justice.

Drivas paid wages to several restaurant employees in both payroll checks and cash, and he did not report the cash wages to the IRS or pay employment taxes on them, causing employment tax losses of $439,341, the US Attorney’s Office said.

Employers are required to withhold an amount for income taxes, social security, and Medicare taxes from employee wages, the statement said.

Drivas also took over $1.5 million in state meals taxes paid by restaurant customers which he was supposed to pay to the state, authorities said.

In Massachusetts, all owners and operators of restaurants and bars are required to collect 6.25 sales taxes on meals, and Salem and Peabody require restaurants and bars to collect an additional 0.75% local option meals excise tax, according to the statement.

Drivas pleaded guilty to five counts of failure to collect and pay over employment taxes owed to the IRS, and four counts of wire fraud for state meals taxes he collected from restaurant customers but did not pay to the Massachusetts Department of Revenue.

Drivas’ sentencing is scheduled for Dec. 5.

Boston.com Today

Sign up to receive the latest headlines in your inbox each morning.