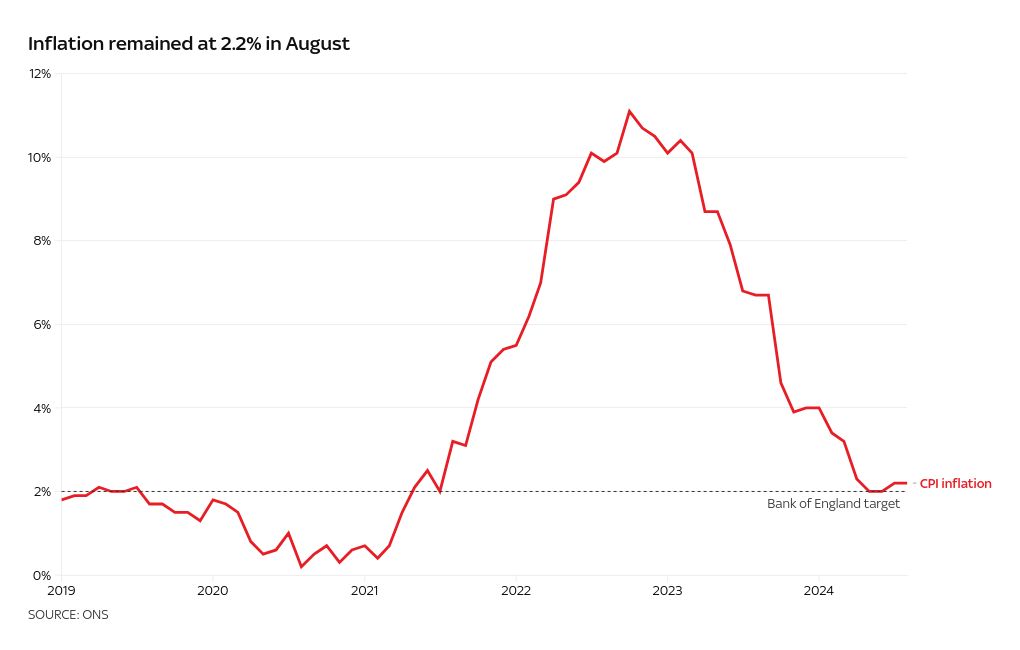

There’s been no change in the rate of price rises, official inflation figures showed.

The rate of inflation stood at 2.2% in August, the Office for National Statistics said, the same as a month earlier.

The announcement comes the day before interest rate setters at the Bank of England decide on the cost of borrowing, controlled through the interest rate.

Markets are expecting only a 37% chance of an interest rate cut.

But another measure of inflation ticked unexpectedly up – core inflation rose to 3.6%, even higher than economists had forecast.

Bank officials closely watch core inflation as it gives a reading on price rises without elements like food and energy which are prone to rise and fall quickly.

A rise in core inflation to 3.5% had been anticipated.

Why?

The main item acting to bring up inflation was airfares to European destinations which showed a large rise during the months, following a fall a year ago, the ONS said.

Lower restaurant and hotel costs and the cheaper price of refilling a tank of petrol or diesel were a balance against the air far rise, as was slightly cheaper shop-bought alcohol.

Cheaper oil prices also meant the cost of raw materials was down, which meant the cost of goods leaving factories slowed.

This breaking news story is being updated and more details will be published shortly.

Please refresh the page for the fullest version.

You can receive breaking news alerts on a smartphone or tablet via the Sky News app. You can also follow @SkyNews on X or subscribe to our YouTube channel to keep up with the latest news.